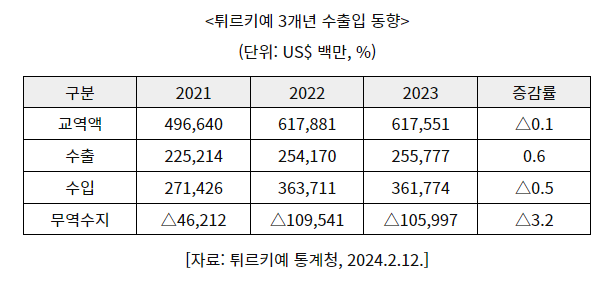

2023 Turkiye import and export trends, external exports reach the highest level of $255 billion

Turkiye’s export volume in 2023 reached $255.7 billion, achieving the $255 billion export target for 2023 set in the medium-term development plan. The global automobile market, which had been sluggish so far, is showing signs of recovery, led by Europe, and as semiconductor supply normalized, the automobile industry appears to have recovered and contributed to the increase in exports. Imports amounted to $361.7 billion. The decline in Turkiye’s imports can be attributed to the success of the commercialization of domestic natural gas and the domestic production of intermediate goods.

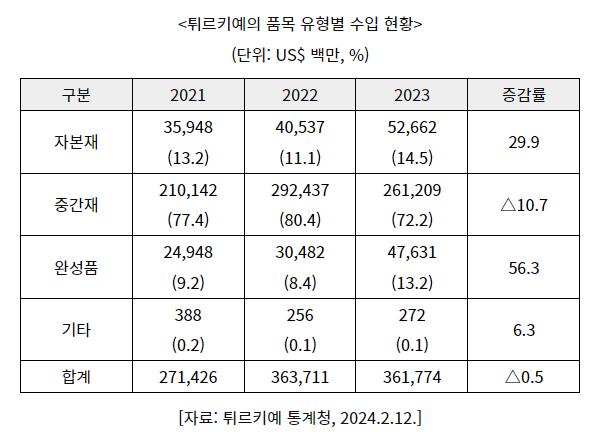

In Turkye, imports of capital goods and intermediate goods amount to 85% of total imports. To improve the trade balance, the Turkic government aims to domestically produce intermediate goods and reduce dependence on energy imports. In this context, Turkiye adopts a pragmatic foreign policy and strives to strengthen diplomatic relations with Middle Eastern countries, while actively pursuing policies to produce intermediate goods and foster high value-added industries. As part of these efforts, Turkiye’s trade balance in 2023 improved compared to the previous year.

In 2023, Turkiye’s imports of intermediate goods decreased by 10.7% to $261.2 billion, thanks to the Turkic government’s policy of localizing intermediate goods. According to investment education statistics released by the Turkiye Central Bank (TCMB), investment across the manufacturing industry increased by 26.4% in 2023. Accordingly, Turkiye’s capital goods imports increased by 29.9% compared to the previous year.

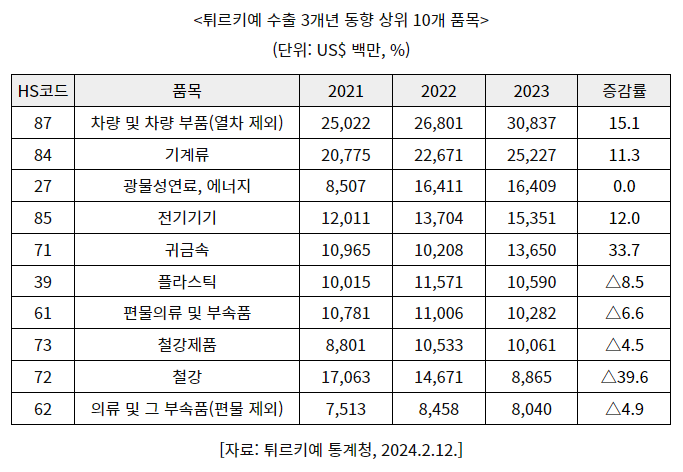

Among Turkiye’s main export items in 2023, exports of automobiles, machinery, fuel, and electrical appliances (home appliances) increased. Senur Aken Bicher, CEO of the Turkiye Association of Small Appliance Manufacturers (KESID), said that he is focusing on developing innovative products by breaking away from price competition in overseas markets and increasing technological capabilities to differentiate himself from products from major competitors. The reason why the export amount of mineral fuel is high is because crude oil is imported from Turkiye, processed into gasoline, diesel fuel, aviation fuel, marine fuel, etc., and then re-exported.

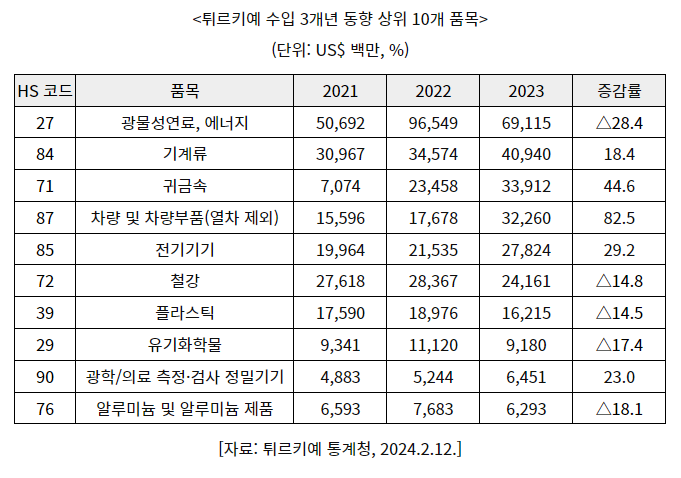

In 2023, Turkiye’s energy imports decreased by about 28%, contributing to alleviating the country’s trade deficit. Natural gas was discovered in the Black Sea four years ago, and commercialization was successful within three years, with supply starting in April 2023. Meanwhile, due to the continued decline in the value of the lira, demand for gold, a safe asset, has steadily increased, and precious metal imports in 2023 have increased by 44% compared to the previous year.

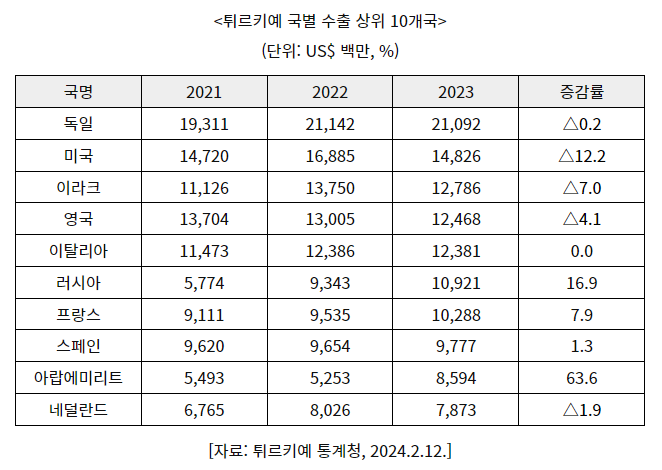

The top three export countries for Turkiye in 2023 are Germany, the United States, and Iraq, with European countries occupying the top three major export countries for Turkiye. This is because many European automobile and home appliance brands produce finished products in Turkiye and export them to Europe.

In 2023, Turkiye’s trade with the United Arab Emirates increased significantly. Exports to the United Arab Emirates increased by 64% compared to the previous year, and the top export item was precious metals, followed by automobiles and bituminous oil. In addition to the United Arab Emirates, Türkye is focusing on strengthening cooperation with Iraq, Saudi Arabia, and Egypt, and trade with Middle Eastern countries is expected to expand in the future. In February 2024, RAMSA, a Turkic defense company, signed a $120 million drone technology investment contract with Saudi Arabia, and President Erdogan visited Egypt for the first time in 12 years and held a summit.

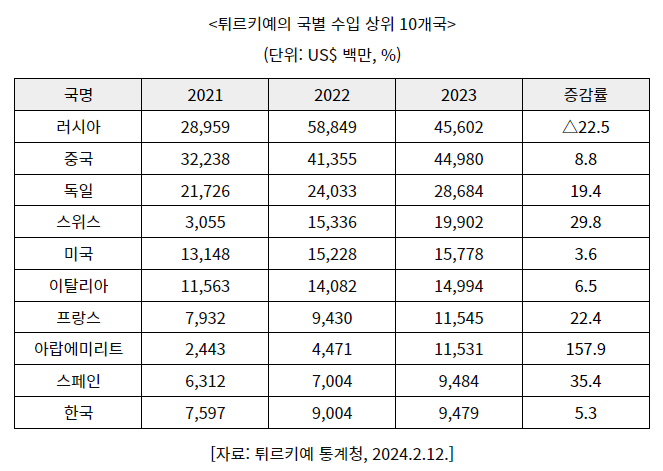

The main import destinations for Turkiye in 2023 are Russia, China, and Germany. Russia’s largest export item to Turkkiye is natural gas, which is a major trading partner of Turkiye, which imports a high proportion of energy. China mainly imports raw materials such as steel slag, inorganic compounds, machinery, and textiles, as well as copper and nickel. In Germany, import demand is steadily increasing in the automobile parts, machinery parts, steel, aluminum, and petrochemical sectors.

Imports from the United Arab Emirates increased by 158% compared to the previous year, and imports of precious metals, including pearls, increased by 207% compared to the previous year. Additionally, imports of aluminum products also increased significantly.

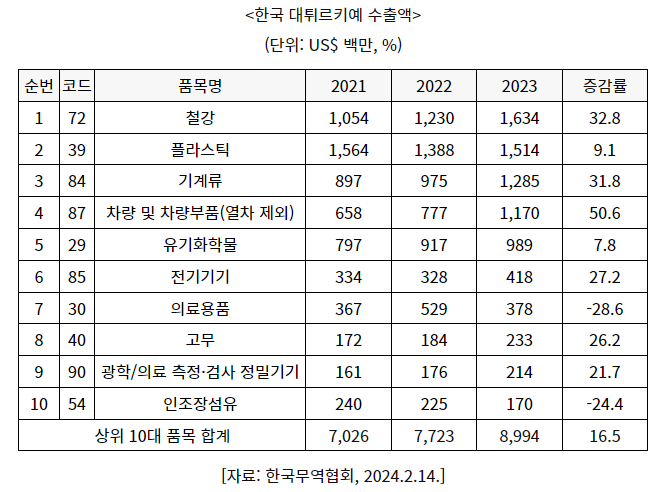

In 2023, Korea’s exports to Greater Turkey amounted to $9 billion, and imports amounted to $1.4 billion. As of 2023, Turkiye ranks 13th among Korea’s export destinations and 39th among import destinations. Looking at the export amount by item, steel products increased significantly by 32.8% and machinery by 31.8% compared to the previous year. This appears to be due to increased demand for steel and wire rods due to earthquake area reconstruction projects and increased facility investment in the Turkiye manufacturing sector. Exports of plastics and organic chemicals, which are Turkiye’s main export items, also increased. As a result of an interview with Yavuz, Chairman of the Turkiye Plastics Association, it is said that Turkiye has a high demand for importing plastic materials from Korea, especially homopolypropylene, PP copolymer, ABS, SAN, and polycarbonate.

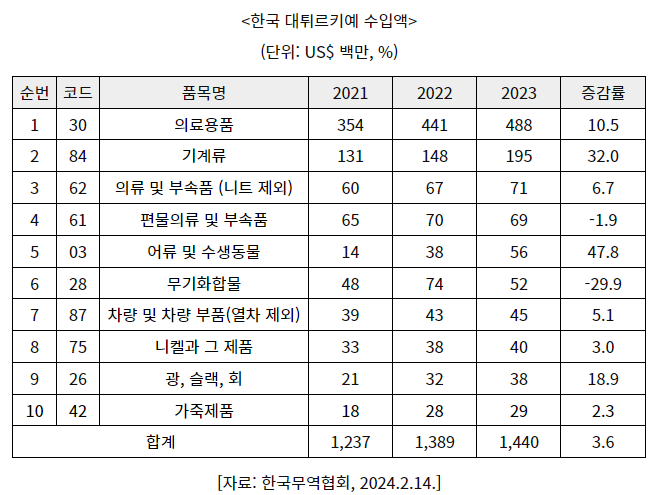

Korea’s imports of Great Turkiye amounted to $1.4 billion. Korea imports medicines, machinery, clothing, and knitted fabrics from Turkicje, and the import volume of fishery products from Turkicje has also increased recently.

Turkiye’s export volume in 2023 recorded $255.7 billion, improving its trade balance. It is expected that the trade balance deficit will continue to ease in 2024 thanks to the Turkic government’s policy of localizing intermediate goods, improving energy independence, and expanding cooperation with Middle Eastern countries.

Trade with Korea was centered on exports of intermediate goods as before, and exports of steel, wire rods, and machinery increased significantly due to increased investment in facilities. In addition, as the Turkic government is expected to continue to pursue the policy of localizing intermediate goods, it seems necessary to diversify expansion plans such as technological cooperation and joint investment, focusing on industries that are strategically fostered by Turkicy, such as the defense industry and energy industry, in addition to the existing export industry.

Turkye is our 13th export destination country and our 39th import destination country. Accordingly, efforts to create a complementary trade environment are believed to be meaningful. It appears that there will be measures to expand imports of the large amount of mineral resources owned by Turkye and expand local investment.

Editor James