Canada enforces mandatory use of online customs system for importers from May

Starting May 13, the Canada Border Services Agency (CBSA) will require Canadian importers to use a new online customs system, CARM (Canada Border Services Agency’s Assessment and Revenue Management). CARM is a platform that allows users to pay customs fees and taxes online and manage accounting-related documents, targeting commercial importers. The implementation of the CARM system does not directly affect Korean companies exporting to Canada, but it is important to note that when sending goods for commercial purposes, receipt is only possible if the recipient is registered with CARM. Additionally, if you are registered as a non-resident importer in Canada or if you are a Korean company with a local corporation, you may need to register with the CARM system to minimize unnecessary delays or problems that may occur during the customs clearance process.

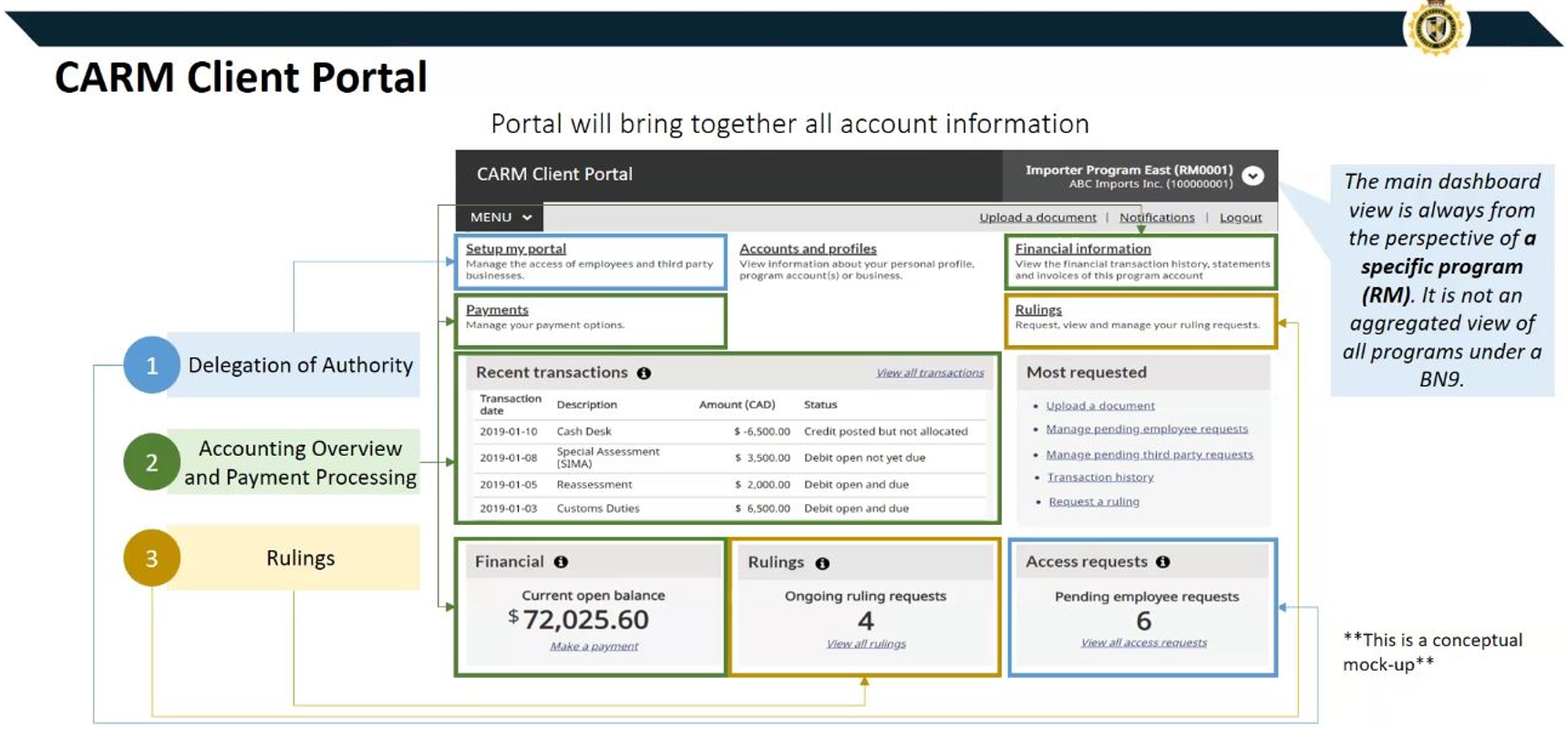

What is CARM ?

<CARM system>

[Source: CBSA]

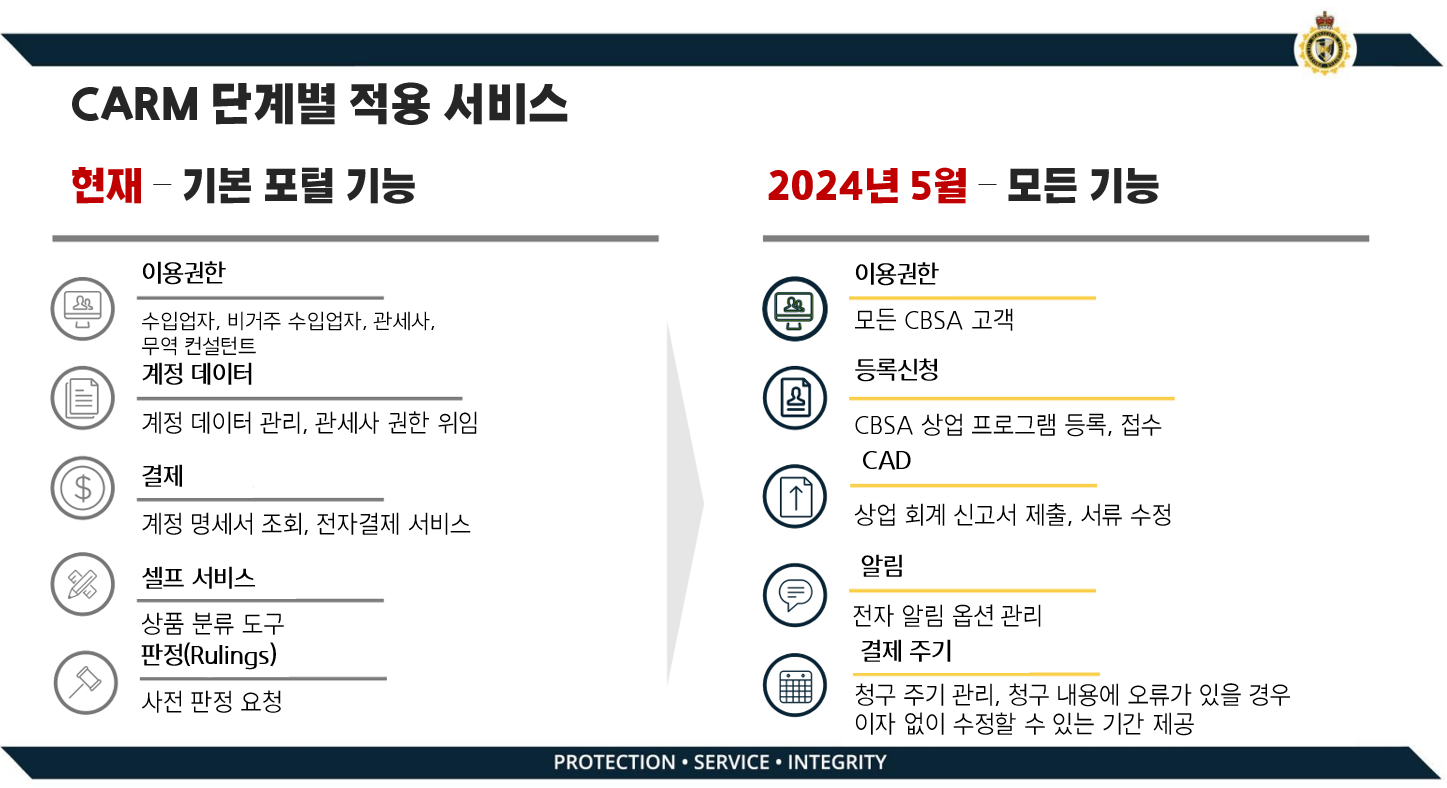

CARM is a system introduced by the Canada Border Services Agency (CBSA) to modernize and streamline customs assessment and management, enabling importers and customs brokers to calculate taxes and duties, make electronic payments, classify goods, and submit electronic documents online. It allows you to do it. The first phase of this system service began in May 2021, enabling the use of some functions, such as electronic payments, and all functions will be available from May 13th. Starting May 13, online applications through CARM will be available for importer and exporter account registration, which previously required separate applications and long waits through the Canada Revenue Agency.

<CARM available services>

[Source: CBSA, KOTRA Vancouver Trade Center self-edited]

The main function introduced in this second phase conversion is the Release Prior to Payment (RPP) program. Through this program, importers can receive shipments of goods before paying duties and taxes to the CBSA and can defer payment of duties and taxes. All importers wishing to participate in the RPP program must register with RPP and provide financial security. Before the introduction of CARM, financial guarantees on behalf of intermediaries such as import agencies or customs brokers were possible, but from May 13, importers must register financial guarantees in their accounts. Importers who are not registered with RPP must pay customs duties and taxes in full and submit a Customs Accounting Declaration for customs clearance. To prevent confusion that may arise in the early stages of using RPP services, CBSA recommends that if you wish to register for RPP, you complete RPP registration before the official service start date.

CARM registration target

CARM registration targets include businesses involved in the trade process, such as importers, customs brokers, trade consultants, and financial guarantors. Imports for non-commercial purposes, such as for personal use, are excluded from registration. In the case of Korean companies exporting products to Canada, they may be subject to CARM system registration even if they deliver products to a local warehouse, such as a local corporation or an Amazon seller, so they must carefully review the need for registration. CBSA defines the following cases as eligible for CARM registration:

• In rare cases of importing commercial products once or twice a year.

• If you import commercial goods through a customs broker.

• Importing commercial goods via courier

• If you are importing goods for the purpose of selling them in the future

• If you are a Non-Resident Importer (NRI)

• If you are importing goods for purposes related to commercial, industrial, occupation or organization

NRI refers to a business located outside of Canada acting as an importer within Canada. In this case, products can be imported into Canada even if there is no actual physical business in Canada. A representative example is an Amazon seller living overseas who sends products from Korea to an Amazon warehouse in Canada and sells them directly. Additionally, local corporations operating in Canada must register as importers if they receive goods related to commercial use or work. If you are eligible for registration, CBSA recommends that you register on the CARM Customer Portal as soon as possible to avoid delays in receiving your items. Registration acceptance will be suspended from April 26 to May 13 due to system implementation preparations, so you must complete the registration process before this period.

How to register CARM

CARM registration is done through an online process through the CARM Client Portal (CCP).

1. Visit CCP: Access the official website https://ccp-pcc.cbsa-asfc.cloud-nuage.canada.ca/en/homepage .

2. Designate a Business Account Administrator (BAM): Upon initial registration, the user will be designated as the lead administrator for the business account and will be responsible for managing business information in the CARM Client Portal.

3. Prepare required information: Business registration number (BN9) and import/exporter program account information are required. This information is used to log in and create a profile.

4. Create a user profile and register as a co-administrator: Log in through GCKey (ID and password for using Canadian online government services) or Sign-In Partner (Canadian financial institution registration information).

5. Enter business information: Enter company information such as business corporation name and address.

6. Security question and answer settings: Set security questions and answers to secure your account.

The registration process for the CARM system is simple, and if you have the necessary information, you can register and manage it yourself. If you use a local customs clearing company or customs declaration service, you can delegate registration and management authority to the company. CBSA regularly holds webinars to support importers who are experiencing difficulties with registration and access, and provides additional support through a dedicated inquiry line.

- Canada Border Services Agency CARM Registration Customer Support Center

1. Online inquiry: Client support contact form: Canada Border Services Agency (cbsa-asfc.gc.ca)

2. Telephone inquiry: +1-800-461-9999 (Operating hours: Monday to Friday, 7:00 AM to 5:00 PM (Eastern Standard Time), excluding holidays)

implication

CARM, which is being fully introduced after several years of preparation by CBSA, is expected to experience some delays and inconveniences in the early stages of introduction, but once the system is stabilized, customs clearance procedures for imported goods are expected to be carried out more quickly and efficiently. At the same time, the overall computerization of commercial import records is expected to significantly improve the transparency of Canada’s import and export processes in the long term. The introduction of this CARM system is expected to have little direct impact on Korean companies exporting to Canada. However, if the Canadian buyer or importer is not registered in the CARM system, the possibility of additional procedures, customs clearance delays, or pending situations must be considered. Additionally, even when shipping goods to Canada for non-commercial purposes, care must be taken when completing shipping documents. This is because the CBSA may consider the recipient a commercial importer and require CARM registration. For importers subject to CARM registration, it is important to take preemptive action to prevent problems that may arise in the early stages of CARM system introduction. Local customs clearance agencies recommend that importers who have not yet registered with CARM register with the CARM system as soon as possible before the official implementation of the service, as there is a possibility that unexpected congestion and customs clearance delays may occur after the official implementation of the system. In addition, in terms of supply chain management, for inventory-sensitive items, it was advised that an increase in order quantity could be considered in advance before the formal introduction of CARM.

(Data: Comprehensive data from Canada Border Services Agency, PCB, Livingston, Farrow, and KOTRA Vancouver Trade Center)

Editor Jun Beom