In 2023, South Korean SMEs’ exports recorded $111.8 billion, showing a slight decrease of 2.3%

The Ministry of Small and Medium Enterprises and Startups (MSS) has released preliminary figures for “2023 SME Export Trends.”

[1] Export amount and distribution of exporting companies for small and medium-sized enterprises (SMEs)

In 2023, SME exports fell 2.3% to $111.8B from the previous year. Despite the decline, SMEs have maintained a three-year consecutive export performance exceeding $110B since the record-breaking $110B achieved in 2021.

* SME exports ($100 million): (2021) 1,155 (+14.7%) → (2022) 1,145 (△0.9%) → (2023) 1,118 (△2.3%)

The trend of decline in exports that started in the second half of 2022 continued in the first half of 2023. However, from August 2023, there was a shift towards an increasing trend as compared to the previous year. This led to a rebound in exports in the second half of 2023, which helped to reduce the overall decline in SME exports.

* SME export amount and percent change (unit: $100 million, and percent in monthly average by quarter): 2023.1Q 91 (△8.0) → 2Q 95 (△3.5) → July 90 (△5.5) → Aug 90 (+0.6) → Sep 94 (+1.8) → Oct 91 (+2.7) → Nov 99 (+10.6) → Dec 98 (△1.2)

** Rate of increase in semiannual exports of 2023 (compared to the same period the previous year, %): (first half) △5.8, (second half) +1.4

The number of SMEs exporting increased by 2.4% from 92,448 to 94,635. New exporting SMEs rose 6.0% YoY, and export discontinuation SMEs decreased by 1.9%, indicating an overall improvement in SME export indicators.

[2] Analysis of the SME exports based on the product and country

<Major Export Items>

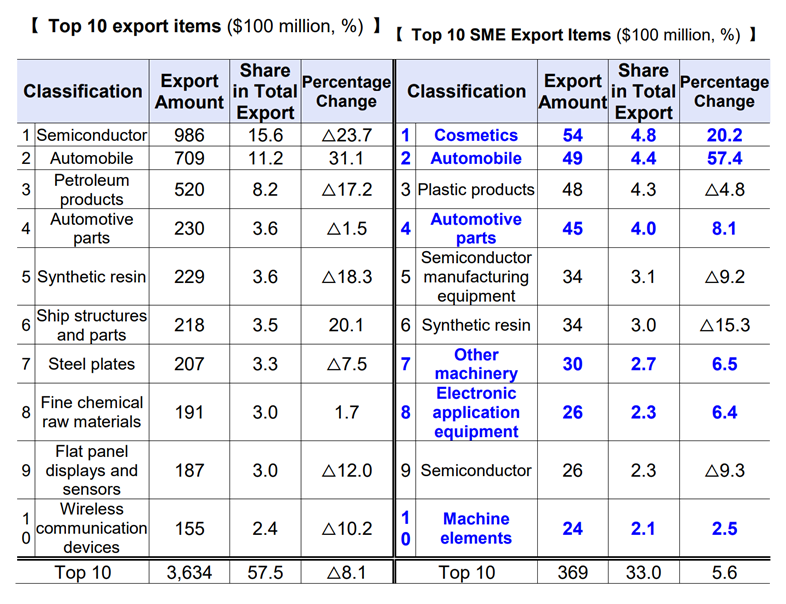

Small and medium-sized enterprises (SMEs) showed impressive export performances in cosmetics, automobiles, plastic products, and automotive parts. The top 10 exported items made up only 33.0% of the total SME exports, which is lower than the overall exports, where the top 10 items constituted 57.5% of the total exports.

Among the top 10 export items, cosmetics rank first and experienced a 20.2% increase, while automobiles rank second with a significant 57.4% increase. The export of automobile parts, other machinery, electronic application devices, and mechanical elements also showed a positive trend.

After analyzing the contributing factors for the increase in key export items, it was found that the rise in automobile exports was due to several factors. The suspension of automobile production in Russia as a result of the war and the increased demand for used cars in neighboring countries such as Kyrgyzstan (an increase of 315.0%) and Kazakhstan (an increase of 21.4%) played a significant role in this increase. Furthermore, there was an increasing trend in the export of used cars to the Middle East, particularly to Libya (an increase of 120.1%).

In the cosmetics industry, there was a decrease in exports to China (△14.4%). However, SMEs achieved their highest annual cosmetic export performance on record due to the diversification of export destinations to countries such as the United States (+47.2%), Japan (+12.9%), Vietnam (+28.6%), and others.

Exports of automotive parts to countries with automobile manufacturing facilities, such as the United States (+7.0%), Mexico (+18.4%), and Japan (+9.9%), have increased due to the automotive industry’s prosperity.

<Major Export Destinations>

The top 10 countries in terms of export amounts for SMEs are ranked as follows: China, the United States, Vietnam, Japan, and India. Export amounts to the United States, Russia, and Mexico increased.

The export amounts of major items, including automotive parts, cosmetics, and machinery, to the United States have risen the most among all exporting countries in 2023. The increase in exports to Russia was mainly due to the growth in cosmetics and automotive parts. The expanding local automotive production facilities in Mexico have led to an increased demand for automotive parts, which has contributed to the increase in exports.

In addition to the top 10 countries for SME exports, notable export growth was observed in the Middle East (+6.6%, +$360 million) and the European Union region (+4.3%, +$690 million) for SMEs.

[3] SME online export sales

In 2023, the online export sales of small and medium-sized enterprises (SMEs) reached $760 million, showing an 11.3% increase compared to the previous year. SMEs accounted for 76.5% of the total online export sales, which amounted to $990 million, indicating their leading position in domestic online export sales.

The top categories for SME online export sales are cosmetics (31.6%, ranking 1st) and stationery/toys (135.3%, ranking 3rd), such as K-pop idol goods, both experiencing a robust rise.

The number of SMEs engaged in online export sales increased to 4,116, up 8.2% from the previous year – an increase of 312 companies.

CHOI Wonyoung, Director-General for Global Growth Policy, stated, “In 2023, small and medium-sized enterprises (SMEs) exports witnessed a decline compared to the previous year. This can be attributed to the uncertain economic conditions prevailing in the external environment, such as the economic slowdown in China and fiscal tightening measures amidst high inflation. Despite this, there were some positive developments, such as SMEs diversifying their export destinations and increasing the number of exporting SMEs.”

He added, “We plan to strongly support SME exports and maintain export growth from the second half of 2023 through 2024.”

Editor Jun Beom