Income deduction for movie tickets, up to several percent (%)… What will change from next month?

The effective date of income deduction for movie tickets will start on the 1st of next month, and credit card payments for movie tickets will be included in the subject of income deduction.

On the 30th, the government published a booklet titled ‘This will change from the second half of 2023’, which contains 186 policy changes collected by 34 government agencies, ministries, offices, and committees. The booklet includes content and support/procedures for stalking crimes, victims of charter fraud, including the application of income deduction for movie tickets, and will be implemented from next month.

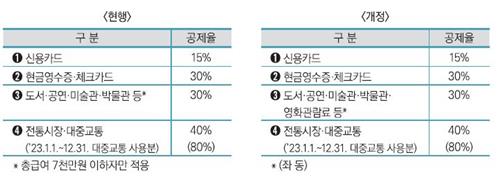

From July 1, when paying for a movie with a credit card, check card, or cash receipt, up to 30% of the movie ticket fee can be deducted from income. First of all, the government decided to add movie tickets to credit card income deductions in order to support the cultural life of the working class and the middle class.

In addition, the government decided to end the policy of reducing the flexible tax rate by 30% in the first half of this year in order to stimulate domestic demand in accordance with Corona 19, including support for the cultural life of the common people and the middle class. Therefore, the measures to reduce the flexible tax rate for individual consumption tax on automobiles will end on the same day.

In addition, the upper limit on the number of mileage accrual on the Thrift Transportation Card was increased from 44 to 60 per month, increasing the monthly transportation cost savings from KRW 11,000 to KRW 48,000 to KRW 15,000 to KRW 66,000.

Meanwhile, various measures to support victims of charter fraud are scheduled to start on July 2nd instead of the 1st of next month.

[Editor Junbeom]