Europe’s future new industry hub, the V4 market, needs attention

provided by the Korea International Trade Association (KITA)

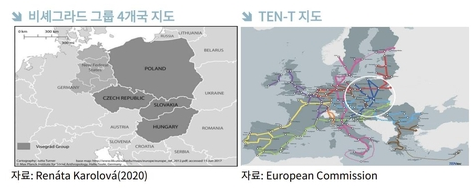

Since joining the EU (2004), the Visegrad 4 countries (V4)*, which have led the growth of European manufacturing through export-led economic development, have recently re-emerged as the center of European high-tech industries, expanding opportunities for Korea’s new growth industry exports.

*Visegrad 4 countries: Poland, Hungary, Czech Republic, Slovakia

According to a report titled “Promising Export Items of the Visegrad 4 Countries (V4), a Base for Advancing into Europe,” published on the 13th by the Korea International Trade Association (KITA, Chairman Jin-sik Yoon) International Trade Research Institute, the V4 countries, which have driven economic growth through automobile and electronics manufacturing, are focusing on fostering cutting-edge, high value-added industries after the pandemic, and structural changes are occurring in the local import market.

In addition, economic cooperation between Korea and the V4 countries is expanding beyond trade in goods such as automobile parts to future cutting-edge industries such as nuclear power plant construction, defense industry cooperation, renewable energy, and aerospace. The report selected 26 promising export items for Korean companies to the V4 countries, considering ① growth potential, ② marketability, and ③ potential, paying attention to changes in the markets of the V4 countries.

Among the 21 core industries representing Korea’s export competitiveness, the analysis of 7 industries in which imports from the V4 countries have increased significantly over the past 5 years and Korea has a high market share included 6 new growth industries including biohealth, robots, new energy industries, next-generation semiconductors, aerospace, and electric vehicles, while automobile parts was the only existing mainstay industry included.

In particular, among the 26 promising export items in the seven key industries, industrial welding equipment robots, ultrasonic imaging diagnostic equipment, battery insulators (separators), and aircraft heat exchangers are items where Korean companies are globally competitive, and continued growth and export expansion are expected in the future.

Meanwhile, trade between Korea and the V4 countries is steadily increasing. As of 2023, the volume of trade with the V4 countries reached a record high of USD 26.1 billion. Over the past 20 years (2004-2023), the volume of trade between the two regions has increased by an average of 15% per year, more than doubling the growth rate of Korea-EU trade (annual average of 6.3%) during the same period.

As economic cooperation and trade expand, the number of domestic companies exporting to V4 countries is also increasing. As of 2023, the number of domestic companies exporting to V4 countries is 5,871, an increase of approximately 17% compared to 2019 (5,018 companies).

Hong Ji-sang, team leader of the supply chain analysis team at the Korea International Trade Association, said, “The relationship between Korea and the V4 countries is being upgraded from economic cooperation centered on manufacturing to a strategic partnership in comprehensive areas such as joint development of nuclear power plants and weapons systems, stabilization of supply chains, and regional security.” He emphasized, “As protectionism, heightened geopolitical conflicts, and supply chain uncertainty are deepening, we need to enhance economic cooperation and trade structures with the V4 countries that are emerging as hubs of European advanced industries, and strategically strengthen trade cooperation based on comprehensive economic cooperation.”

Editor. Hong Se-yeong